The Single Strategy To Use For Paul B Insurance

Wiki Article

Paul B Insurance for Dummies

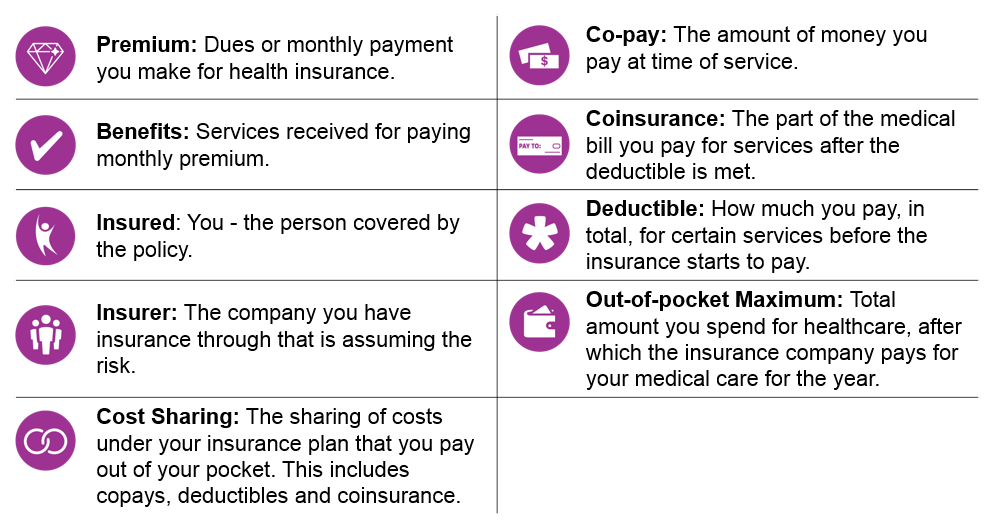

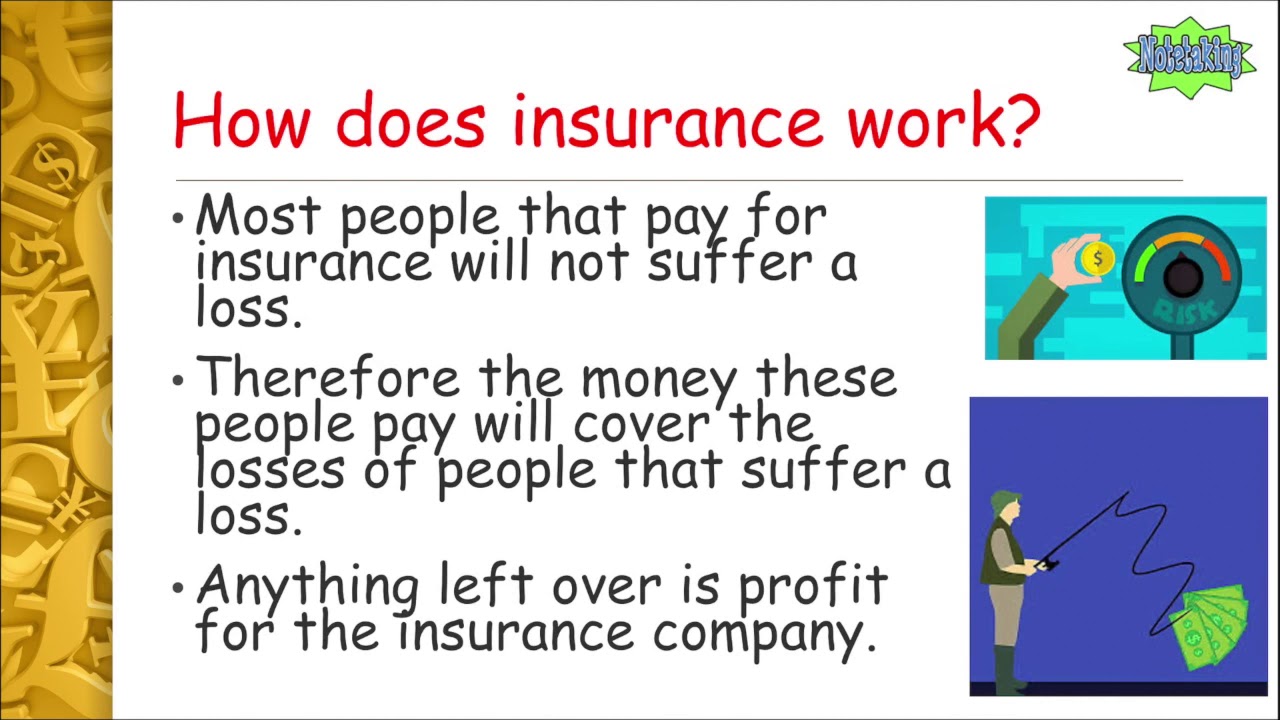

The idea is that the cash paid out in insurance claims in time will be much less than the overall premiums collected. You might feel like you're tossing money gone if you never ever file a claim, however having piece of mind that you're covered in the event that you do endure a substantial loss, can be worth its weight in gold.

Envision you pay $500 a year to insure your $200,000 residence. You have ten years of paying, and also you have actually made no claims. That appears to $500 times ten years. This means you have actually paid $5,000 for home insurance policy. You begin to wonder why you are paying a lot for nothing.

Because insurance policy is based upon spreading out the danger among lots of people, it is the pooled money of all individuals spending for it that enables the firm to develop properties and cover insurance claims when they happen. Insurance policy is a company. Although it would certainly be good for the companies to just leave rates at the same level all the time, the fact is that they have to make adequate cash to cover all the potential insurance claims their policyholders may make.

4 Simple Techniques For Paul B Insurance

Underwriting changes and also price boosts or decreases are based on results the insurance firm had in previous years. They offer insurance coverage from only one company.

The frontline people you manage when you buy your insurance are the representatives as well as brokers who represent the insurance provider. They will certainly describe the sort of items they have. The captive agent is a representative of only one insurer. They a knowledgeable about that business's items or offerings, however can not talk towards various other business' policies, rates, or product offerings.

How much danger or loss of cash can you think on your own? Do you have the money to cover your expenses or financial debts if you have a crash? Do you have unique needs in your life that need additional insurance coverage?

The Greatest Guide To Paul B Insurance

The insurance coverage you need differs based upon where you go to in your life, what type of possessions you have, as well as what your long term goals and responsibilities are. That's why it is essential to take the time to discuss what you desire out of your plan with your representative.

If you get a lending to buy an automobile, as well as then something happens to the car, void insurance policy will certainly settle any section of your car loan that common auto insurance does not cover. Some loan providers require their borrowers to lug void insurance policy.

The primary function of life insurance coverage is to provide cash for your recipients when you die. Depending on the type of plan you have, life insurance coverage can cover: Natural deaths.

visit the site

Everything about Paul B Insurance

Life insurance covers the life of the guaranteed person. Term life insurance covers you for a period of time selected at purchase, such as 10, 20 or 30 years.

Term life is preferred because it offers large payouts at a lower cost than long-term life. There are some variations of common term life insurance coverage plans.

Long-term life insurance policy plans develop money value as reference they age. A part of the premium see post repayments is included in the cash value, which can earn passion. The money worth of entire life insurance plans expands at a fixed rate, while the cash value within global plans can rise and fall. You can make use of the money worth of your life insurance policy while you're still active.

8 Easy Facts About Paul B Insurance Described

$500,000 of entire life coverage for a healthy and balanced 30-year-old female expenses around $4,015 yearly, on standard. That same level of insurance coverage with a 20-year term life plan would set you back a standard of about $188 each year, according to Quotacy, a brokerage firm.

Those investments come with even more threat. Variable life is another long-term life insurance policy option. It appears a whole lot like variable universal life yet is actually different. It's an alternate to entire life with a set payment. Nevertheless, insurance policy holders can make use of investment subaccounts to grow the money value of the plan.

Right here are some life insurance policy essentials to help you better understand how coverage works. Premiums are the settlements you make to the insurance firm. For term life policies, these cover the expense of your insurance policy and also administrative expenses. With a long-term plan, you'll also be able to pay money into a cash-value account.

Report this wiki page